In this article, we will do the Consignment Accounting Solution of BCOC-131 Financial Accounting Assignment of IGNOU for the year 2021-22.

Problem Given:

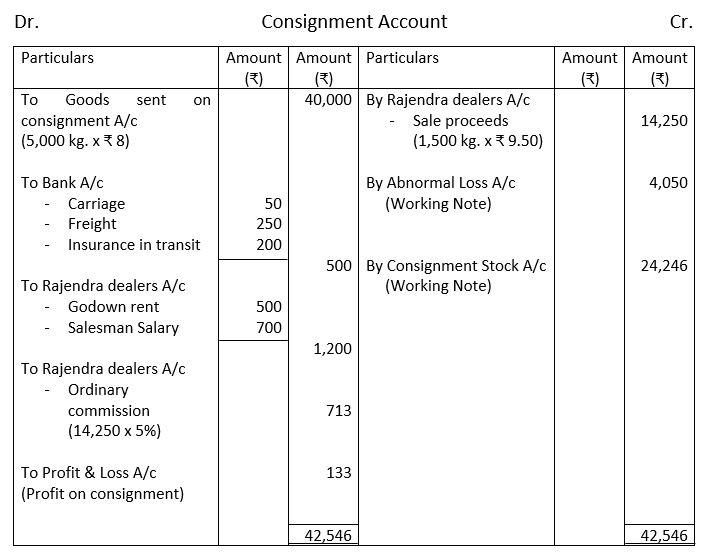

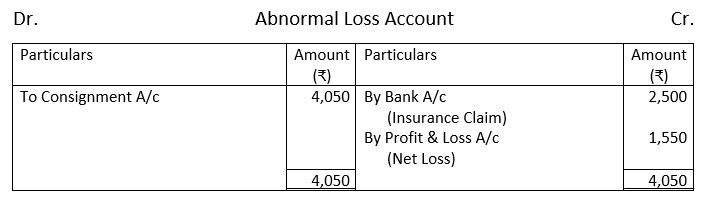

Oswal Mills Barnala consigned 5,000 kg. of vanaspati ghee of Rajendra Dealers of Panipat. Each kg. Ghee costs ₹ 8. Oswal Mills paid ₹ 50 for carriage, ₹ 250 for freight and 200 for insurance in transit. During transit 500 kg. Ghee was accidentally destroyed for which insurance company paid directly to the consignor ₹ 2,500 in full settlement of the claim. After 3 months from the date of consignment of goods to Panipat, Rajendra Dealers reported that 1,500 kg. Ghee was sold at ₹ 9.50 per kg. The expenses were: On Godown Rent ₹ 500, On Salesman Salary ₹ 700. Rajendra Dealers are entitled to a commission of 5% on sales. Due to leakage, Rajendra dealers also reported a loss of 20 kg. Ghee. Prepare Consignment Account and Abnormal Loss Account in the books of the Consignor.

Solution:

In the books of Oswal Mills (Consignor)

Read Also:

Journalize the following transactions, post them into Ledger and prepare a Trial balance.

Make necessary ledger accounts in the books of Harpal Singh.

Rectify the errors and prepare the suspense Account.

Define Computerized Accounting and distinguish between manual and computerized accounting system.

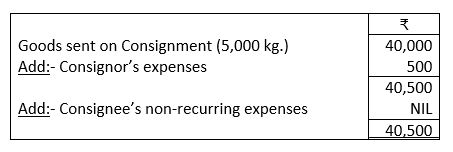

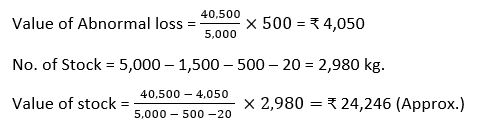

Working Note:–

Liked our post?

We are available with lots and lots of commerce-related content.

[…] Consignment Account Solution […]

[…] Consignment Account Solution […]

[…] Consignment Account Solution […]